Daily Legislative Update: Monday, March 17, 2025

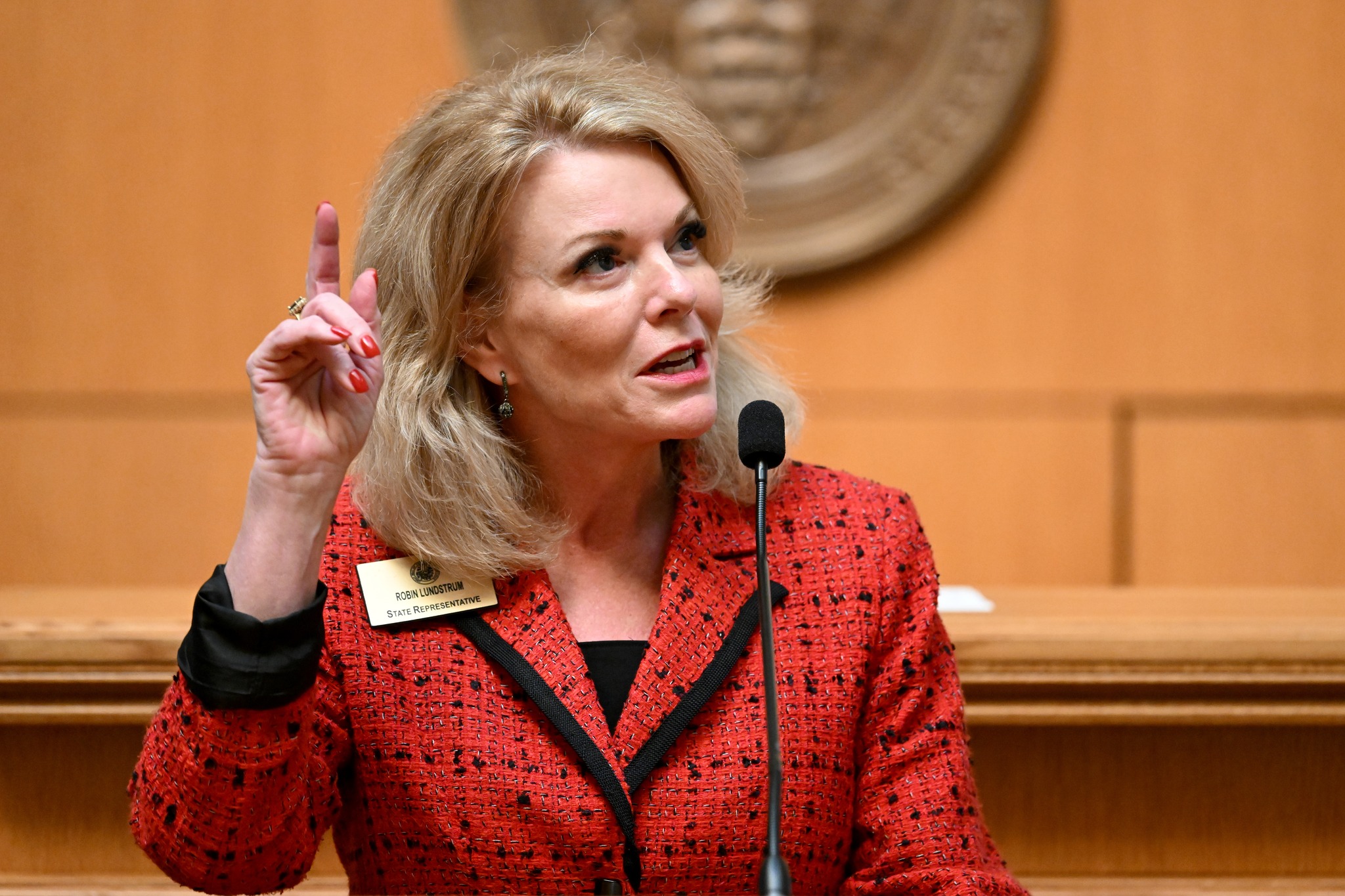

Photo by Will Newton/Arkansas House of Representatives

Monday, March 17, 2025 – Day 63

LEGISLATIVE SCHEDULE

The Senate Education committee met at 9:30 a.m. The House and Senate will convene at 1:30 p.m. The Senate Transportation and Judiciary committees, the House Insurance and Commerce Committee, and the Joint Education Committee will all meet after adjournment. To view committee schedules, agendas, and live streams—including live coverage of the House and Senate—visit www.arkleg.state.ar.us.

The General Assembly plans to recess for spring break from March 24-28, and aims to adjourn by April 16.

CALLS TO ACTION

ASK STATE SENATORS TO OPPOSE SB 284, 285, 286, 287 and SB 288.

Workers’ Compensation Bills – Sen. John Payton

In committee on Wednesday, Dale Douthit, chairman of the Arkansas Workers’ Compensation Commission testified that, “rates are going to be affected. All these bills are labor leaning, and they are going to have an effect on workers’ compensation rates in Arkansas. These bills will increase costs for employers. These bills will most likely increase litigation in workers’ comp. They will most likely cause the Workers’ Compensation Commission to hire more staff. It will have an impact and without knowing that impact, I would be hesitant to go down that road.”

These bills affect all employers, not just businesses. Colleges, K-12 schools, state, county, city governments and non-profits will all be faced with increased costs.

Why Do These Bills Matter?

- Workers’ Compensation is one of Arkansas’ most competitive business cost elements. It is a key measure of our overall economic standing compared to other states.

- The cost of doing business is one of the top five factors influencing investment location decisions.

- These bills will undermine recent years’ improvements in operating costs through tax reductions.

- In short, these bills will undermine all of the State’s efforts to attract business and industry and create and maintain jobs.

- Any one of these bills alone will increase the cost of doing business; passing more than one of these bills will make that exponentially worse

- Employers are already on edge because of concerns with the economy. Common sense dictates that we do not impose additional costs on them during this uncertainty.

Please contact state senators. To leave a message dial 501-682-2902.

Just ask them to Vote NO on SB 284, 285, 286 and 288.

For more details, see the “Call to Action Bills” section below.

ASK STATE REPRESENTATIVES TO SUPPORT SB 307

SB 307 – Sen. Jonathan Dismang and Rep. Les Eaves

Randy Zook, our president and CEO, emphasized the importance of this bill, stating, “Economic growth from higher value-added jobs is right at our fingertips. Electrons equal growth equal jobs equal tax revenue.” He emphasized that this bill is the economic development opportunity of this generation—an opportunity to ensure Arkansas remains competitive in attracting and retaining businesses.

This bill provides key benefits like:

- Providing much needed expansion of electricity capacity.

- Preventing sudden, steep rate hikes by spreading costs over time.

- Lowering borrowing costs, leading to more stable, long-term electricity rates for consumers.

- Supporting economic growth by ensuring affordable and reliable energy.

- Providing surplus power-generating capacity to meet rising demand.

- Enhancing Arkansas’ appeal for business expansion and reducing the risk of companies relocating to areas with greater power availability.

This bill awaits consideration in the House Insurance and Commerce Committee.

The State Chamber/AIA Executive Committee has voted to support SB 307. The bill is also supported by Gov. Sarah Huckabee Sanders, a bipartisan group of legislators and economic developers across the state.

Ask state representatives to vote YES on SB 307.

To leave a message dial 501-682-6211.

For more details, see the “Call to Action Bills” section below.

AT THE CAPITOL: A SYNOPSIS OF WHAT YOU NEED TO KNOW

Today at the Capitol

Four workers’ compensation bills we oppose (SB 284, 285, 286, and 288) are scheduled for consideration on the Senate floor this afternoon. Meanwhile, SB 307, the energy bill we support, is the sole item on the House Insurance and Commerce Committee’s agenda. We also support SB 403, which would establish a Complete Count Committee for the 2030 Census; it is also set for review on the Senate floor this afternoon.

Additionally, we have concerns regarding SB 258, the Arkansas Digital Responsibility, Safety, and Trust Act, which seeks to regulate technology privacy and artificial intelligence (AI). While we support efforts to strengthen digital privacy protections, we believe the bill’s AI provisions are premature and should be removed. The Senate Transportation, Technology, and Legislative Affairs Committee is expected to review the bill this afternoon following recent amendments.

Several bills we support are scheduled for committee review today:

- SB 390, which establishes an apprenticeship program, is on this morning’s agenda in the Senate Education Committee.

- HB 1446, which aligns with the adoption of Issue 1 in the 2024 General Election by expanding lottery scholarships for workforce training, is on this afternoon’s agenda in the House Education Committee.

- HB 1706, which would prohibit ranked choice voting, is set for review today in the House State Agencies Committee.

Two bills we oppose—which have been pending since the start of the session—have recently been amended and are now on today’s agenda in the Senate Judiciary Committee:

- SB 5, which establishes a criminal offense for prescription drug harm or homicide.

- SB 6, which introduces a criminal offense for vaccine harm.

Tomorrow at the Capitol

The House Revenue and Taxation Committee will meet on Tuesday, and any of the pending tax reduction bills could be discussed, including our tax package (HB 1500, 1501, 1538, and 1750). We will be present in case testimony is needed on any of these bills.

The Tax Foundation has identified these measures as critical to improving Arkansas’ tax competitiveness ranking:

- HB 1500 – Repeals the throwback rule

- HB 1501 – Aligns Arkansas’ income tax law with federal standards for expensing depreciable business assets

- HB 1538 – Extends the net operating loss carryforward period

- HB 1750 – Repeals the franchise tax

The committee has been reviewing, but not yet voting on, bills with state revenue implications. This approach allows the General Assembly to finalize budgetary plans before implementing any tax reductions.

Other tax-related bills we support are still awaiting consideration in the same committee, including:

- HB 1435 – Provides income tax credits for childcare

- HB 1469 – Establishes the Broadband Expansion and Efficiency Act

- HB 1116 – Modernizes tax laws for remote and mobile workers

For more details, see the “Tax Bills We Support” section below.

We also plan to testify before the House Education Committee on Tuesday in support of HB 1571, which amends the Arkansas Adult Diploma Program Act—a valuable program we have supported in the past.

Additionally, we support HB 1731, which re-establishes a child labor certificate. It is scheduled for review tomorrow in the House Public Health, Welfare, and Labor Committee.

We oppose HB 1656, which seeks to modify existing royalty contracts. It is scheduled for discussion tomorrow in the Senate Agriculture and Economic Development Committee. For more details, see the “Bills We Oppose” section below.

Tax Bills We Support

Our tax package includes four bills. The Tax Foundation has identified these measures as key to improving Arkansas’ tax competitiveness ranking.

- HB 1500 – Repeals the throwback rule

- HB 1501 – Aligns Arkansas’ income tax law with federal standards for expensing depreciable business assets

- HB 1538 – Extends the net operating loss carryforward period

- HB 1750 – Repeals the franchise tax

These bills remain under consideration in the House Revenue and Taxation Committee, which has been reviewing but not yet voting on bills with state revenue implications. This practice allows the General Assembly to finalize budgetary plans before enacting tax reductions.

Other tax-related bills we support are still pending in the same committee, including:

- HB 1435 – Provides income tax credits for childcare

- HB 1469 – Establishes the Broadband Expansion and Efficiency Act

- HB 1116 – Modernizes tax laws for remote and mobile workers

For more details, see the “Tax Bills We Support” section below.

Pending Bills We Support

The State Chamber/AIA supports several key bills aimed at workforce development, employment regulations, and government operations.

- HB 1446 – Expands the Arkansas Workforce Challenge Scholarship Program, improving access to workforce training opportunities.

- SB 390 – Establishes a State Apprenticeship Agency to enhance workforce development initiatives.

- SB 403 – Creates the 2030 Arkansas Complete Count Committee, ensuring an accurate and thorough census count for the state.

- SB 279 – Clarifies the process for investigating wage and hour complaints.

- HB 1706 – Prohibits the use of ranked-choice voting in Arkansas elections.

- HB 1731 – Reinstates a requirement for employment certificates for children under 16, reinforcing labor protections for minors.

- SB 361 – Creates the Industrial Development Authorities Expansion Act.

- SB 421 – Authorizes the Arkansas Natural Resources Commission to issue general obligation bonds.

For more details, see the “Pending Bills We Support” section below.

Pending Bills We Oppose

The State Chamber/AIA opposes several bills that could negatively impact industries, business operations, and regulatory frameworks in Arkansas.

- HB 1656 – Amends oil and gas royalty laws.

- HB 1150 – Restricts healthcare payors and pharmacy benefits managers from obtaining specific pharmacy permits, which could limit market competition.

- HB 1442 – Places additional restrictions on pharmacy contracting, potentially increasing costs for businesses and consumers.

- SB 7 – Grants legislators the ability to request sales and use tax reports, raising concerns about confidentiality and business privacy.

- SB 5 – Establishes a criminal offense for prescription drug harm or homicide, potentially leading to unintended legal consequences.

- SB 6 – Introduces a criminal offense for vaccine harm, which could create legal uncertainties for healthcare providers and businesses.

- SB 456 – Creates the Home Opportunities Made Easier Act. This bill is concerning to several local chambers of commerce.

For more details, see the “Bills to We Oppose” section below.

Constitutional Amendments

The State Agencies Committees are currently reviewing Joint Resolutions that propose constitutional amendments for referral to the 2026 General Election Ballot. The State Chamber/AIA supports SJR 15 and HJR 1014, which are companion bills aimed at improving the state’s legal and regulatory framework.

For further information, see the “Constitutional Amendments” section below.

NEWLY TRACKED BILLS

We added four bills to our tracking list based on those filed on Friday. As of Friday, a total of 797 bills have been filed in the House and 465 bills in the Senate, bringing the combined number of bills and resolutions from both chambers to 1,460.

HB 1797 – Rep. Howard Beaty and Sen. Ben Gilmore

Amends the law regarding the Arkansas Development Finance Authority, modifies provisions from Initiated Act 1 of 2000, and declares an emergency. Filed .

SB 462 – Sen. Jamie Scott

Creates a certificate of employability for individuals with felony convictions and allows issuance by the Division of Correction and circuit courts. Filed .

SB 463 – Sen. Matt McKee and Rep. Matt Brown

Requires the Public Service Commission to approve or deny settlement agreements related to the closure or elimination of electric generation units or transmission assets. Filed.

SB 465 – Sen. Breanne Davis and Rep. Carol Dalby

Provides for a sales and use tax refund for speculative development projects and requires concurrent financial incentive agreements under the Consolidated Incentive Act of 2003. Filed.

CALL TO ACTION BILLS

SB 284-288 – Sen. John Payton

Specifically these bills will:

- SB 284 and 288: Allow an annual change of physician instead of a one-time change. SB 284 addresses personal physicians, while SB 288 addresses specialty physicians. While employers must cover all job-related injuries, they can direct care. Annual changes could encourage “doctor shopping,” disrupt treatment plans, increase medical costs, prolong claims, delay recovery, and effectively provide lifetime medical benefits.

- SB 285: Dramatically raise the maximum benefit amount by over 255%, setting an annual cap of $120,000—the highest in the nation. (Annualized, our current weekly benefit maximum is $46,956.) Arkansas’ current weekly maximum of $903 would jump to $2,307.69, one of the highest in the country. This increase would create a financial strain on employers and Arkansas would be misaligned with neighboring states.

- The National Council on Compensation Insurance (NCCI), a nationally recognized group with expertise in these matters, has done an initial evaluation of SB 285. It will cost the workers’ compensation system $12 million to $16 million annually.

- Our cap already exceeds that of Mississippi and Louisiana; this will widen the gap dramatically, making Arkansas less competitive for industry and business investment.

- SB 286: Expand wage loss disability benefits in ways that would make the system less predictable.

- Currently, those benefits are largely determined on objective measures that derive the percentage of impairment, as assigned by a physician, and applied to the rate schedule.

- This bill would allow the Workers’ Compensation Commission to be able to increase those benefits, over and above the schedule, based on subjective criteria that includes age, education, work experience, and “other matters.”

- According to the NCCI, this bill will result in an “indeterminate increase in cost to the system.”

These bills await consideration on the Senate floor.

SB 307 – Sen. Jonathan Dismang and Rep. Les Eaves

SB 307 helps Arkansas meet rising electricity demand due to growth in manufacturing, transportation electrification, data centers, and population increases by allowing utility providers to implement a proactive approach to meeting electricity demand. Utility companies will be allowed to implement gradual, annual rate adjustments to help fund new power plant construction, rather than imposing large, sudden rate hikes once a plant is completed. Under this bill, utilities can request incremental rate adjustments—known as riders—by filing annually with the Public Service Commission (PSC), which must review and approve them to ensure they serve the public interest. Under this proposal, rate increases cannot exceed 10% below the national average unless justified by economic development benefits.

This bill awaits consideration in the House Insurance and Commerce Committee.

TAX BILLS WE SUPPORT

HB 1500 – Rep. Howard Beaty and Sen. Ben Gilmore

Enhances economic competitiveness by repealing the throwback rule. This bill awaits consideration in the House Revenue and Taxation Committee. This bill is part of the State Chamber/AIA tax package. We support this bill.

HB 1501 – Rep. Howard Beaty and Sen. Ben Gilmore

Adopts federal income tax law regarding depreciation and expensing of property; increases the allowable amount for expensing certain depreciable business assets to align with federal law. This bill awaits consideration in the House Revenue and Taxation Committee. This bill is part of the State Chamber/AIA tax package. We support this bill.

HB 1538 – Rep. David Ray

Seeks to extend the state’s existing net operating loss carry forward law from 10 years to 20 years. This bill awaits consideration in the House Revenue and Taxation Committee. This bill is part of the State Chamber/AIA tax package. We support this bill.

HB 1750 – Rep. Frances Cavenaugh

Repeals the Arkansas Corporate Franchise Tax Act of 1979 and makes conforming changes. This bill awaits consideration in the House Revenue and Taxation Committee. This bill is part of the State Chamber/AIA tax package. We support this bill.

HB 1435 – Rep. Brandon Achor and Sen. Jane English

Seeks to amend the law regarding income tax credits for childcare by modifying the employer-provided childcare credit and establishing a new income tax credit for licensed childcare providers. This bill awaits consideration in the House Revenue and Taxation Committee. We support this bill.

HB 1469 – Rep. Howard Beaty and Sen. Blake Johnson

Creates the Broadband Expansion and Efficiency Act and a sales and use tax exemption for machinery and equipment used in producing broadband communications services. This bill awaits consideration in the House Revenue and Taxation Committee. We support this bill.

HB 1116 – Rep. David Ray and Sen. Jonathan Dismang

Seeks to establish the Remote and Mobile Work Modernization and Competitiveness Act. The bill proposes income tax and withholding exemptions for certain remote and mobile employees as well as nonresidents. This bill awaits consideration in the House Revenue and Taxation Committee. We support this bill.

PENDING BILLS WE SUPPORT

HB 1446 – Rep. Robin Lundstrum and Sen. Jane English

Seeks to amend the Arkansas Workforce Challenge Scholarship Program by adding the ability for scholarship funds to go towards a public or private vocational – technical school or institute in Arkansas. The bill is focused on associate degrees or certificate programs that result in a portable license or certificate in high demand fields including manufacturing, health care trades, information technology, construction trades and logistics and distribution. This bill awaits consideration in the Joint Education Committee. We support this bill.

SB 390 – Sen. Jane English and Rep. Robin Lundstrum

Establishes the State Apprenticeship Agency Act. This bill awaits consideration in the Senate Education Committee. We support this bill.

SB 403 – Sen. Clarke Tucker and Rep. Howard Beaty

Creates the 2030 Arkansas Complete Count Committee to improve awareness and participation in the 2030 federal census. This bill awaits consideration in the Senate State Agencies Committee. We support this bill.

SB 279 – Sen. Missy Irvin and Rep. Jeremy Wooldridge

Seeks to assist the division of labor with enforcing the fair and prompt payment of wages to Arkansas citizens; and to clarify the manner in which wage and hour complaints are investigated. This bill awaits consideration in the House Public Health, Welfare and Labor Committee. We support this bill.

HB 1706 – Rep. Austin McCollum and Sen. Bart Hester

Prohibits ranked-choice voting in Arkansas elections. This bill awaits consideration in the House State Agencies Committee. We support this bill.

HB 1731 – Rep. DeAnn Vaught

Strengthens child labor laws by reinstating employment certificate requirements. This bill awaits consideration in the House Public Health, Welfare and Labor Committee. We support this bill.

HB 1571 – Rep. David Ray and Sen. Breanne Davis

Amends the Arkansas Adult Diploma Program Act. This bill awaits consideration in the House Education Committee. We support this bill.

SB 361 – Sen. Tyler Dees and Rep. Howard Beaty

Creates the Industrial Development Authorities Expansion Act to establish industrial development authorities for securing and fostering economic growth. Referred to the Senate Agriculture and Economic Development Committee. This bill is supported by the Northwest Arkansas Council, and we echo their support.

SB 421 – Sen. Bart Hester and Rep. Howard Beaty

Authorizes the Arkansas Natural Resources Commission to issue general obligation bonds for water, waste disposal, and pollution abatement projects. Scheduled for hearing in the Senate Agriculture and Economic Development Committee. This bill is supported by the Northwest Arkansas Council, and we echo their support.

PENDING BILLS WE OPPOSE

HB 1656 – Rep. Rick Beck and Sen. Breanne Davis

Amends laws related to oil and gas production and conservation. One of the primary problems with the bill is it upends a decades-long legal standard and seeks to undo terms of existing contracts. This would violate the “Contracts Clause” of the Arkansas and U.S. Constitutions.

Another provision would require operators and working interest owners to provide a statement of accounting that is “itemized for each separate deduction” and “clearly identifies” each deduction’s purpose and amount. This would prevent the use of an industry standard of bundling expenses into categories to improve efficiency. This provision would lead to check stubs having dozens or hundreds of pages of detail. Such a detailed requirement would invite numerous lawsuits.

The bill seeks to undue a law that has been in place since 1985 regarding royalty payments in a way that would create liability for reimbursing any unauthorized deductions within 30 days, regardless of who made them.

Finally, these royalty issues have been adjudicated numerous times in federal court, and all were decided in favor of the industry. This bill awaits consideration in the Senate Agriculture and Economic Development Committee. We oppose this bill.

SB 418 – Sen. John Payton

Amends the Workers’ Compensation Law to require workers’ compensation insurers to spend at least 85% of premiums on healthcare and wage claims. This bill awaits consideration in the Senate Public Health, Welfare and Labor Committee. We oppose this bill.

HB 1150 – Rep. Jeremiah Moore and Sen. Kim Hammer

Prohibits healthcare payors and pharmacy benefits managers from obtaining specific pharmacy permits. This bill is pending in the House Insurance and Commerce Committee. We oppose this bill.

HB 1442 – Rep. Brandon Achor and Sen. Dave Wallace

Seeks to set restrictions on pharmacy contracting and conflicts of interest and to establish pharmaceutical patient freedom of choice. This bill presents the significant risk of the regulation of self-insured employer health plans and is likely preempted by ERISA, which prohibits states from dictating employers’ self-funded health plan structures, and therefore is likely to face a legal challenge if adopted. This bill is pending in the Senate Public Health, Welfare, and Labor Committee. We oppose this bill.

SB 7 – Sen. Clint Penzo

Seeks to allow members of the General Assembly to request a sales and use tax report from the Department of Finance and Administration. This bill is pending in the Senate Revenue and Taxation Committee. We oppose this bill.

SB 5 and SB 6 – Sen. Brian King

SB 5 seeks to add the criminal offense of prescription drug harm or homicide. SB 6 would create the criminal offense of vaccine harm. These bills are pending in the Senate Judiciary Committee. We oppose these bills.

SB 258 – Sen. Clint Penzo and Rep. Stephen Meeks

SB 258, known as the Arkansas Digital Responsibility, Safety, and Trust Act, seeks to address technology privacy and artificial intelligence (AI). Earlier this month, the Senate Technology Committee declined to advance the bill, instead urging the sponsor to revise certain provisions. The bill was amended and is expected to be reconsidered this afternoon in the Senate Transportation, Technology, and Legislative Affairs Committee.

While the State Chamber/AIA and much of the business community recognize the need for a comprehensive privacy bill, we believe changes were necessary to the privacy provisions in SB 258, and we are currently reviewing the latest amendment. However, a major concern remains—the AI section of the bill. The prevailing consensus among businesses is that it is premature to legislate AI at this stage, and we believe this section should be entirely removed from the bill.

SB 456 – Sen. Jim Petty and Rep. Rebecca Burkes

Creates the Home Opportunities Made Easier Act. Local chambers of commerce have expressed concerns about this bill. It awaits consideration in the Senate City, County, and Local Affairs Committee. We oppose this bill.

CONSTITUTIONAL AMENDMENTS

The House and Senate State Agencies Committees are working their way through lengthy lists of joint resolutions proposing changes to the Arkansas Constitution. The legislators will not vote on the resolutions until later in the session.

SJR 15 and HJR 1014 – Sen. Jonathan Dismang and Rep. Howard Beaty

These constitutional amendments concern economic development in the state of Arkansas. They authorize the General Assembly to provide for the creation of economic development districts to promote economic development. We support this joint resolution.